Investment

Market and growth drivers

Market and growth drivers

Kempower operates on the international EV charging market. Megatrends behind EV demand are expected to drive the EV charging market growth.

Megatrends driving growth in EV demand

Vehicle emissions regulations are becoming stricter globally, forcing personal vehicle (PV) manufacturers to manufacture vehicles with less emissions than traditional internal combustion engine (ICE) vehicles. In practice, this is leading PV manufacturers to manufacture more EVs to avoid potentially substantial fines or other negative consequences. There are a number of regulations that are expected to continue driving increased EV demand, which can be divided into three categories: emission standards, credit programmes and limits on the use of ICE vehicles.

In the coming years, the total cost of ownership for EVs is expected to decrease driven by decreasing battery prices1. Battery cell prices are expected to decrease from USD 143/kWh in 2020 to less than USD 100/kWh by 20302. More than 50 percent of this decrease is expected to take place in the next five years, increasing the economic benefits of EV ownership and usage, which, in turn, is expected to accelerate EV penetration in car fleets.

1 Sources: Who Will Drive Electric Cars to the Tipping Point?, June 2021.

2 Sources: Bloomberg: Better batteries, 2019.

Vehicle manufacturers are taking action to respond to the tightening regulation and increasing EV demand. They have announced plans to bring nearly 400 EV models to the personal vehicle market by 2025. This increase in options is expected to accelerate the penetration of EVs, which, in turn, is expected to increase demand for EV charging infrastructure, and, therefore, demand for DC fast charging equipment1. By September 2021, altogether 26 cities had signed on to the C40 Cities Clean Bus Declaration of Intent where they have collectively committed to reducing the emissions of the transportation sector, and to procure only zero‑emission buses from 2025 onwards2

1 Sources: IHS Markit EV Charging Infrastructure Report and Forecast, July 2021 and public announcements made by OEM decision-makers.

2 Sources: C40 Cities Clean Bus Declaration of Intent., July 2021 and public announcements made by OEM decision-makers.

The number of personal and commercial electric vehicles is expected to grow

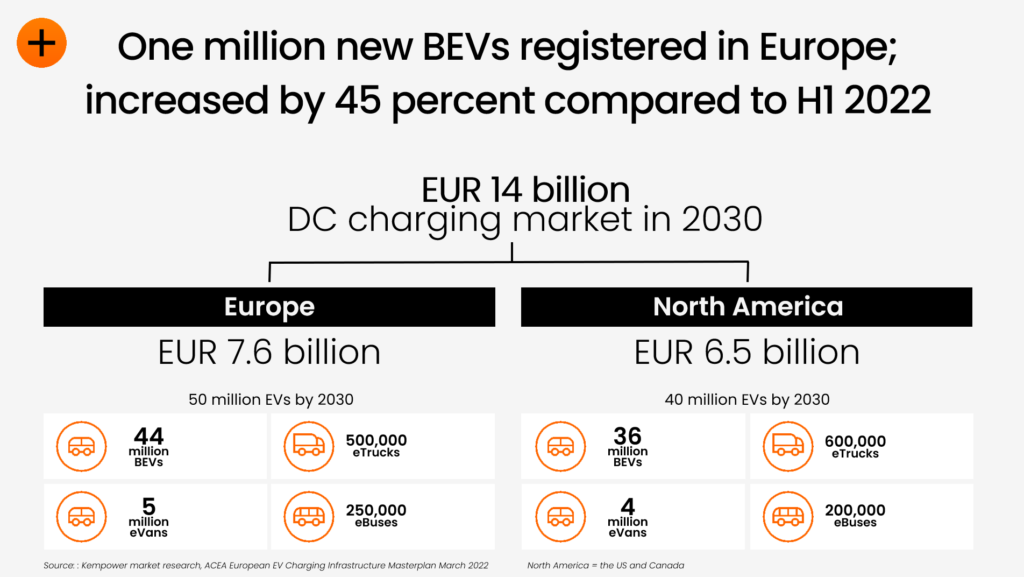

The aforementioned megatrends are expected to drive the increase of personal and commercial EV stocks in both Europe and the United States, and the total EV stock, including both personal and commercial EVs, in the two markets, which are expected to amount to approximately 90 million EVs by 2030.1

Kempower’s target market

We currently target the DC fast charging and high power charger (HPC) equipment markets of EVs in Europe and also see significant potential to expand into the United States. By 2030, the DC fast charging markets in Europe and the United States are expected to increase to EUR 7,600 million and EUR 6,500 million respectively, to an aggregate of approximately EUR 14,000 million, from the approximately EUR 638 million in 2020.1

In Europe, most of the relative growth in the DC fast charging equipment market between 2020 and 2030 is expected to come from commercial vehicle charging, while the largest relative growth contributor in the United States is expected to be personal vehicle charging.

1 Sources: Kempower market research, ACEA European EV Charging Infrastructure Masterplan March 2022